The Workplace Money Coach

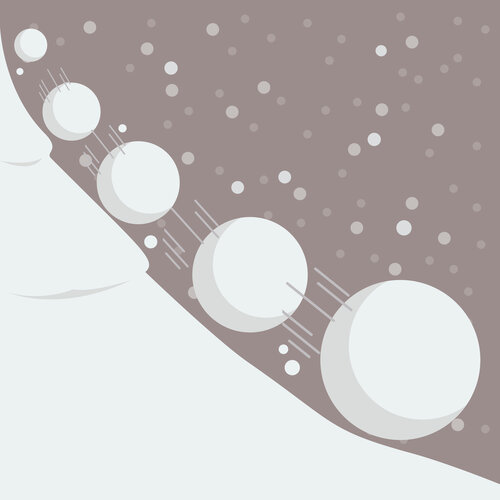

The Debt Snowball is a debt elimination tactic that builds momentum as you keep going. First, you focus on paying your smallest debt (while paying the minimum on other bills). Once your smallest debt is paid, you roll the money you were paying from that debt into the next smallest balance. As you continue to pay off more, the money rolled into the next debt increases until you are paying large amounts towards your largest and final debt.

- Get Organized. Start by using your credit report to make a list of your debts and put them in order from smallest to largest. Create a goal statement for paying off each debt that includes what habit you will change in order to free up cash so you can put it toward the next debt in your snowball. This will help you stay organized and focused. Post the list where you can see it and cross each debt off once you pay them to acknowledge your progress.

- Remember Your “Why”. You will be on a strict budget while you are in debt pay-off mode and it can get frustrating at times. Most people don’t realize that discipline equals freedom and it helps to keep in mind “why” paying off debt is important to you. Is it to prepare for buying a house? Getting ready for retirement? Saving your marriage? Everyone has a reason for getting rid of debt. Find yours and write down every vivid detail of what it will feel like when you’re finally debt-free. Go to that place when you’re tired of the sacrifice because it will motivate you to move forward.

- Drown Out Negative Opinions. While on your debt-free journey, many people will start to question your decisions. Your workplace friends might wonder why you keep saying “no” to eating out for lunch. Your kids might ask why all their other friends get cellphones. Your parents might wonder why you are selling most of your furniture. To everyone else, it might seem a little crazy. Don’t worry too much about their opinions, you know exactly what it takes for your family to be debt-free.

- Find People to Keep You Motivated. Find a friend, family member or co-worker that is motivated to pay off their debt so you can help each other stay focused, vent frustrations and of course, celebrate wins with. It’s easy to feel isolated through this process especially if it spans over a couple of years. With the right support group, you will feel more motivated to tackle your debt.